Explained in 90 seconds

Healthcare systems will benefit from the huge pools of data that have been built up over decades

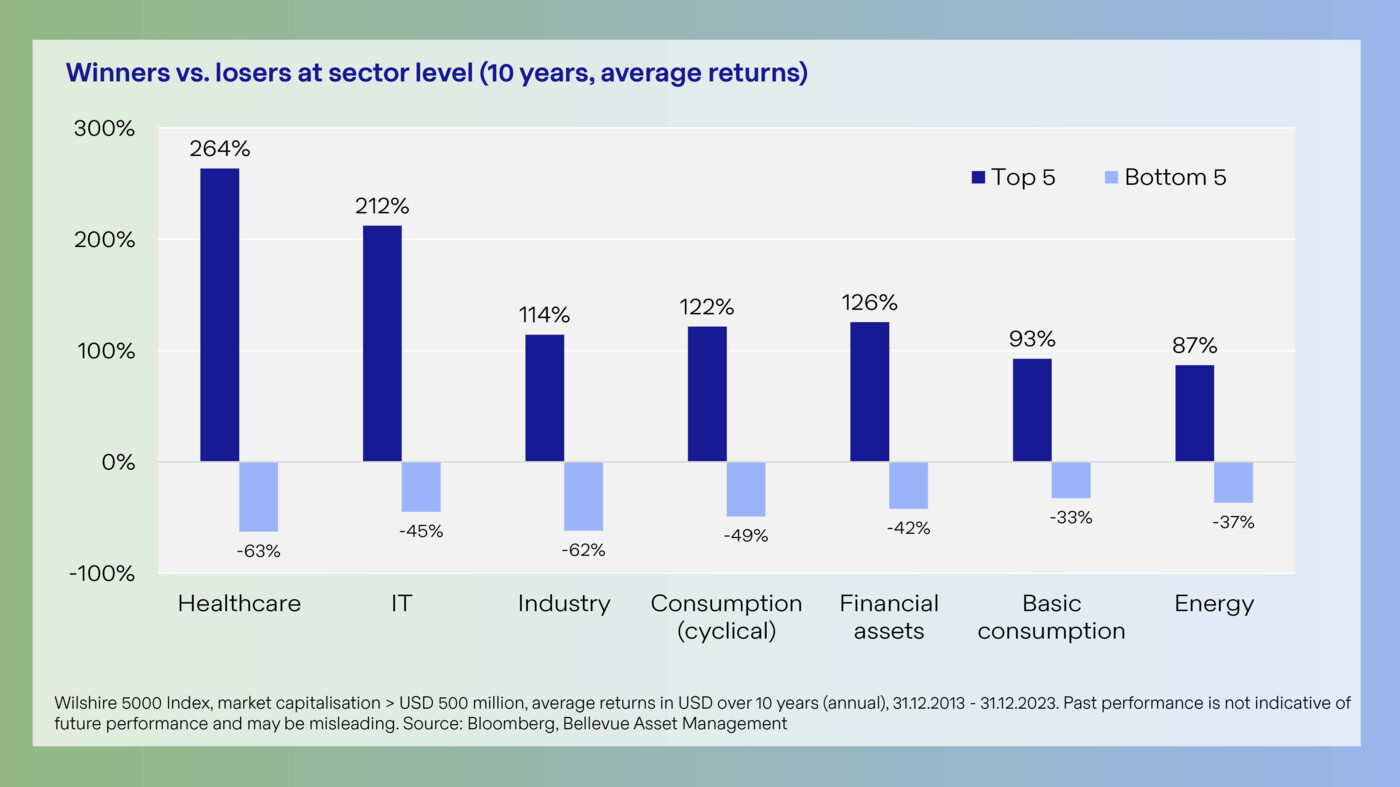

GenAI will be a relevant driver of shareholder value

Sweet spot: Well-capitalized companies with strong AI capabilities

Indexed performance (as at: 26.02.2026)

NAV: CHF 135.41 (25.02.2026)

Rolling performance (26.02.2026)

| B-CHF | Benchmark | |

| 25.02.2025 - 25.02.2026 | -7.23% | -5.44% |

| 25.02.2024 - 25.02.2025 | 3.57% | 3.66% |

Annualized performance (26.02.2026)

| B-CHF | Benchmark | |

| 1 year | -7.23% | -5.44% |

| Since Inception p.a. | 3.63% | 4.38% |

Cumulative performance (26.02.2026)

| B-CHF | Benchmark | |

| 1M | -2.17% | -1.07% |

| YTD | -1.07% | 0.10% |

| 1 year | -7.23% | -5.44% |

| Since Inception | 8.33% | 10.09% |

Annual performance

| B-CHF | Benchmark | |

| 2025 | -0.49% | 0.37% |

| 2024 | 9.82% | 9.40% |

Facts & Key figures

Investment Focus

The fund’s aim is to achieve capital growth in the long term. The Bellevue AI Health Fund is a global equity fund with an actively managed portfolio of 50 to 70 stocks, mostly from the healthcare sector, rounded out with a small number of tech companies that have considerable exposure to the healthcare industry. Show moreShow less

Investment suitability & Risk

Low risk

High risk

General Information

| Investment Manager | Bellevue Asset Management AG |

| Custodian | CACEIS BANK, LUXEMBOURG BRANCH |

| Fund Administrator | CACEIS BANK, LUXEMBOURG BRANCH |

| Auditor | PriceWaterhouseCoopers |

| Launch date | 30.11.2023 |

| Year end closing | 30. Jun |

| NAV Calculation | Daily "Forward Pricing" |

| Cut of time | 15:00 CET |

| Management Fee | 1.60% |

| Subscription Fee (max.) | 5.00% |

| ISIN number | LU2721086259 |

| Valor number | 130851892 |

| Bloomberg | BAIHXBC LX |

| WKN | A3E1ZS |

Legal Information

| Legal form | Luxembourg UCITS V SICAV |

| SFDR category | Article 8 |

Key data (31.01.2026, base currency USD)

| Beta | 0.93 |

| Volatility | 14.74 |

| Tracking error | 5.26 |

| Active share | 22.23 |

| Correlation | 0.94 |

| Sharpe ratio | 0.28 |

| Information ratio | -0.40 |

| Jensen's alpha | -1.90 |

| No. of positions | 71 |

Portfolio

Top 10 positions

Geographic breakdown

Benefits & Risks

Benefits

- GenAI is speeding up the process of digitization and automation across the healthcare system.

- GenAI can enhance patient care, simplify processes and procedures, and lead to better decisions.

- Companies that use or provide GenAI tools for healthcare-relevant purposes will gain a sustainable competitive advantage.

- Shareholder value creation will largely be determined by a company’s AI strategy and its execution.

- Bellevue – a pioneer in healthcare investing since 1993 and now one of the largest independent investors in the healthcare space in Europe.

Risks

- The fund actively invests in equities. Stocks are subject to price fluctuations, so there is a risk of falling prices.

- The investments the fund makes may be denominated in foreign currency, which can entail a foreign-exchange risk relative to the fund's base currency.

- The fund may invest some of its assets in financial instruments that may have relatively low levels of liquidity under certain circumstances, which may then affect the liquidity of the fund’s own shares.

- There are additional risks in the form of political and social unrest when investing in emerging markets.

- The fund may use derivatives. Derivatives offer greater upside potential yet also carry greater downside risk.

Review / Outlook

US labor market data released in January and core inflation for December came in below expectations. The nomination of Kevin Warsh as Fed Chair, who is associated with a clear focus on balance sheet reduction, led to a slight rise in interest rates in January.

The MSCI World and the S&P 500 gained 2.2% and 1.4% respectively in January, while the Nasdaq 100 also advanced by 1.2%. The healthcare sector rose 1.1%, driven mainly by pharmaceutical stocks. The Bellevue AI Health Fund (0.0%) moved sideways and underperformed its benchmark.

BioPharma (57.2% weighting at month-end) contributed 1.9% to absolute performance but detracted slightly from relative performance by -0.2%. The strongest contributors included Gilead (+15.7%), Johnson & Johnson (+9.8%) and Roche (+9.5%), while Alnylam (-15.0%), Daiichi Sankyo (-14.3%) and Eli Lilly (-3.5%) detracted. Gilead Sciences’ share price rose after the launch of Yeztugo, a long-acting agent for HIV pre-exposure prophylaxis (PrEP), exceeded expectations and opened up additional growth opportunities. Alnylam shares corrected after the company reported lower sales of Amvuttra, a treatment for hereditary transthyretin amyloidosis (ATTR), a rare inherited disease in which misfolded proteins accumulate in the body and damage organs such as nerves or the heart.

The medtech segment (27.8%) detracted -0.8% from absolute performance and -0.3% from relative performance. Hoya (+10.6%), Medtronic (+7.2%) and Stryker (+5.1%) delivered the strongest positive contributions, while Beta Bionics (-54.3%), Abbott (-12.3%) and Intuitive Surgical (-11.0%) weighed on performance. Hoya shares advanced after customers such as Seagate and ASML, which use the company’s technologies in the production of hard drives and semiconductors, confirmed robust end-market demand in their quarterly presentations. Insulin pump manufacturer Beta Bionics exceeded revenue expectations by 11% but disappointed on new patient additions and therefore plans to expand its salesforce in the coming months.

Healthcare services (9.4%) detracted from both absolute and relative performance by -0.5% and -0.1% respectively. Labcorp (+8.2%), Sonic Healthcare (+6.1%) and HCA Healthcare (+4.6%) contributed positively, while UnitedHealth (-13.1%), Omada (-5.3%) and Elevance (-1.4%) detracted. HCA surprised with strong Q4 results and guidance for 2026. UnitedHealth, which has a strong exposure to Medicare Advantage, met earnings expectations in the Q4 and confirmed its 2026 earnings guidance, pointing to restructuring progressing as planned. However, preliminary CMS reimbursement rates for Medicare Advantage 2027 were a drag, with an increase of around 0.1%, well below market expectations of 3%–5%. We nevertheless expect higher final rates to be announced in April 2026.

The technology segment (3.1%), which includes companies from the healthcare and information technology sectors, detracted -0.4% from absolute and -0.3% from relative performance. Nvidia benefits from US government approval to export H200 chips to China, which could enable additional annual revenues of an estimated USD 25–30 bn and contribute around USD 0.60–0.70 per share. By contrast, Waystar (-18.9%) and Microsoft (-11.0%) weighed on performance. The expansion of Anthropic’s AI solution “Claude for Life Sciences” into clinical and regulatory applications dampened investor sentiment toward Waystar.

All performance data in USD / B shares.

The rapid development of generative artificial intelligence (GenAI) is ushering in an unprecedented technology-driven transformation that ranks alongside milestones such as the internet, cloud computing and the smartphone. This creates substantial opportunities for companies and investors, particularly in the healthcare sector. A number of studies conclude that healthcare is among the sectors likely to benefit most from the adoption of GenAI, driven by its significant potential for efficiency gains, the large volumes of available data and the substantial financial resources within healthcare systems.

We already see today how drugs are being developed more quickly and with higher probabilities of success, how new diagnostic and treatment methods are leading to better clinical outcomes, and how GenAI is helping healthcare professionals make more informed and better decisions. We focus on healthcare companies that use GenAI as a core element of their business strategy and invest substantial resources in this technology, as this can deliver a sustainable competitive advantage and support above-average value creation. The technology risk is more manageable, given that healthcare is a highly regulated sector.

Dokumente

Show moreShow less