Market commentary: Underestimated newcomers

Many investors think biotech is not a particularly attractive place to be at the moment. The Nasdaq Biotechnology Index, the bellwether index for the biotechnology industry, has fallen nearly 20% over the past 12 months. Although a few sector heavyweights such as Moderna or Regeneron have made considerable gains, most small and mid-cap biotech stocks are trading sharply lower than they were a year ago. This trend is reflected in the 40% drop in the value of the S-Network Medical Breakthroughs Index (PMBI) and the S-Network Healthcare Innovation Index (PHIX). Both indexes include only biotech and pharma stocks in the small and mid-segments that have at least one drug in Phase II or III FDA clinical trials.

Sector rotation in the wake of rising rates of inflation is to blame for the aforementioned downward trend. Investors have been rotating from growth into value and this rotation has been fairly indiscriminate in the biotech sector. Biotech companies that are not yet generating any sales from approved products that they can use to finance their R&D activity have been marked down the most. As interest rates point higher, the discount rates analysts use in their valuation models have climbed as well, which lowers the present value of a company’s future earnings streams. That explains the sweeping sell-off of the biotech sector. However, many small and mid-cap biotech stocks today have strong funding profiles over a mid to long-term horizon and much bigger cash piles than in the past.

From a fundamental standpoint, small and mid-sized biotech companies could benefit the most from a broad recovery in biotech stocks. According to a study by the IQVIA Institute for Human Data Science, 65% of all active ingredients in clinical development worldwide in 2021 were being investigated by biotech companies with less than USD 500 mn in annual sales and an annual R&D budget of less than USD 200 mn. As recently as 2016, less than 50% of all clinical trials were being conducted at such companies, which are classified by IQVIA as Emerging Biopharma Companies. Another statistic in the IQVIA's report indicates just how much these companies have matured in their business development: they filed 76% of their regulatory approval applications in 2021 on their own. That is clear proof that these companies have obtained a high degree financial independence and are thus in a position to commercialize their products on their own without a partner, which translates into higher potential earnings.

Promising R&D pipelines

Within the overall biotech industry, small and mid-caps are becoming better and better at commercializing their discoveries as the leading pioneers of next-generation therapies. Prime examples include cell and gene therapies, gene editing and mRNA technology, which made its big breakthrough with the Moderna and BioNtech COVID-19 vaccines. With some 800 clinical candidates currently attributable to such novel approaches, small and mid-sized biotechs are fundamentally well positioned. The kind of topline news likely to drive stocks higher is there in abundance, too, with plenty of clinical trial results and approval decisions expected this year in areas including oncology, neurology, and rare genetic diseases.

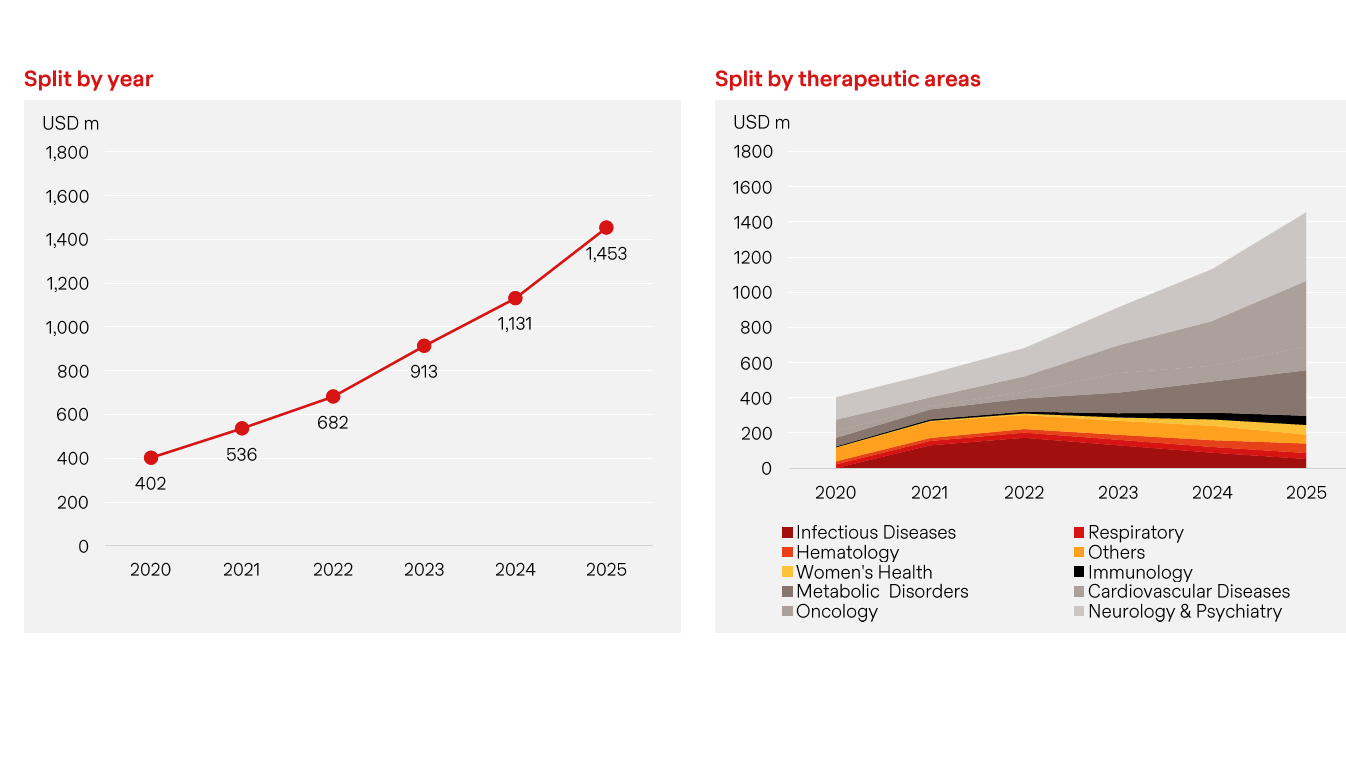

We expect BB Biotech's investment portfolio to reap above average benefits from this activity, with portfolio companies estimated to more than double their annual sales over the next three years. The lion’s share of product approvals are in cancer, metabolic and neurological diseases (Charts 1 and 2). Our portfolio companies Alnylam and Ionis are each anticipating an approval decision in 2022 on a therapy to reduce the symptoms of hATTR amyloidosis, an inherited disorder that causes proteins to accumulate and seriously damage body organs. There are currently no effective treatments for the condition and pricing power is high as a result.

Expected future revenue growth from portfolio companies

In cancer medicine, Arvinas is on the verge of a major breakthrough with its novel technology platform for molecules able to degrade disease-causing proteins, primarily targeting molecules that are untreatable by conventional methods. The pivotal trial for its most advanced product, ARV-110, is scheduled to start this year, and Arvinas is exploring the potential for accelerated FDA approval of this prostate cancer treatment. The company is also launching another two Phase III clinical trials in partnership with Pfizer for ARV-471 in heavily pretreated patients with advanced metastatic breast cancer. Another frontrunner in our investment portfolio is Relay Therapeutics, which leverages artificial intelligence (AI) and machine learning (ML) to uncover the most promising drug candidates. Specifically, Relay models and analyzes protein motion on screen in early clinical trials to study drug-target interactions and uses those insights to identify the molecule with best efficacy profile.

Sentiment is getting better

As positive announcements from the biotech sector grow in number, investor interest in the sector is likely to pick up again. Sentiment is already starting to slowly shift in favor of the biotech sector as a whole. According to a recent investor survey by RBC Capital Markets, 66% of the survey respondents expect biotech to outperform this year. In the latter half of 2021, the percentage of respondents who considered biotech stocks to be undervalued was 49%; now it is 64%. And 58% of the respondents said they were planning to increase their exposure to biotech.