5 reasons for a strong healthcare year in 2026

The sector’s momentum is supported by the following five key developments:

1. Policy clarity is drawing investors back to the sector

The drug price agreement between the US administration and Pfizer announced at the end of September and subsequent deals with Eli Lilly and Novo Nordisk in November were clearly a turning point. These announcements finally created a predictable framework with respect to drug pricing and reimbursement policies, reducing the uncertainty that had been hanging over the sector like a dark cloud and improving planning visibility.

Investors responded quickly to this development: Healthcare has been one of the strongest performers in the global stock market so far this quarter (+9%); biopharma has outperformed the overall market by about 14 percentage points and an additional USD 8 bn in capital was invested in healthcare ETFs worldwide during the past three months alone. Institutionals and generalist investors are returning to the healthcare sector.

2. Re-rating has begun – still more catch-up potential

Healthcare valuations are drifting back toward historical averages, but the sector is still valued at a discount of about 13% to global stocks. The outlook for healthcare companies is bright: Estimated average profit growth for biopharmaceuticals and life science tools during the period from 2024 to 2027 is approx. 15%, which is more than double the historical growth rate of about 7% per year.

3. Powerful growth drivers and high M&A capacity in the biopharma space

Looking ahead to 2026, biopharma stocks stand to benefit from multiple structural trends: Novel treatment classifications in oncology, advancements in treating obesity and diabetes, and therapeutic innovations in cardiovascular care are creating additional market volume. Demand for bioprocessing solutions is growing, too, driven by onshoring activity and new production platforms. The biopharma industry is also sitting on a cash pile of more than USD 180 bn that it can spend on M&A to offset lost revenues in the wake of patent expirations or close strategic gaps in R&D pipelines.

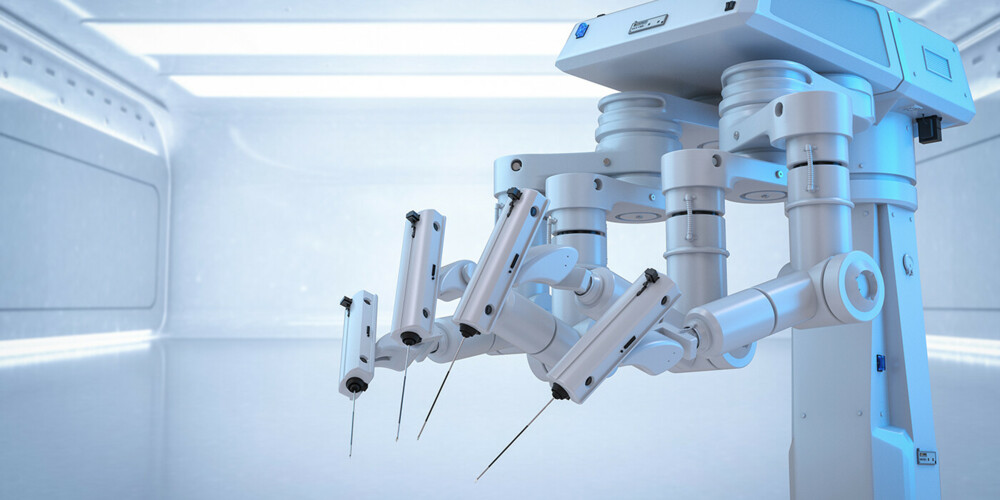

4. From glucose sensors to pulsed field ablation – rapid growth in medtech

Medtech remains a key growth driver, driven by strong levels of demand in established market segments and the recent emergence of new billion-dollar markets. Robot-assisted surgical systems, glucose monitoring devices and structural heart disease treatment are areas that continue to show double-digit growth rates: We project that the addressable market for continuous glucose monitoring solutions will expand from USD 11.7 bn in 2024 to more than USD 21 bn by 2029. New technologies such as pulsed field ablation are rapidly making inroads in clinical care settings and AI-supported smart glasses are gaining ground – EssilorLuxottica’s organic sales growth rate has more than doubled this year, driven by precisely this product category. Medtech valuations are also still attractive: Large-cap medtech stocks are trading at 18.3 times 12-month forward earnings, which represents a discount of about 18% vs the S&P 500.

5. Emerging markets are ramping up their innovation skills and market clout

Emerging markets are steadily becoming innovation powerhouses in their own right. China is in the midst of a significant transformation from an out-licensing partner to a global pharmaceutical player: Chinese companies are bringing a growing number of first-in-class drugs to the market on their own, for example bispecific antibodies in oncology or novel antibody-drug conjugate (ADC) platforms. In India, a rapidly growing middle class and huge government spending on healthcare infrastructure stand out as growth drivers. Chronic disease management is a fast-growing market in this country; private hospital chains are steadily expanding and specialty pharmaceuticals has become a relevant market segment. As a result of these developments, new healthcare ecosystems are emerging in which the newly industrialized countries are no longer simply a part of Western companies’ drug manufacturing and cost structures, but rather the originators of top-quality specialty drugs and global therapy platforms.

Conclusion

The healthcare sector is entering 2026 with strong structural growth drivers and improved earnings visibility. Innovation remains the key factor here, supported by well-filled pipelines, new therapy platforms and tech-enhanced solutions.

Attention is also drawn to the significant divergence in sector performance as measured by the MSCI World Healthcare Index: In the first half of 2025, the performance gap between the best- and worst-performing stocks was quite conspicuous at +72% and -38%. This gap reflects the widening segmentation within the healthcare sector universe, which is an attractive environment for active managers, who can generate significant alpha through diligent stock selection.

After the recent phase of policy uncertainty, healthcare is now back in its historical sweet spot of innovation, growth and high operational visibility, from where it has regularly delivered tangible value.