Medtech & Services sector lives up to its reputation

A stabilization of the interest rate situation appears not too far off and that has positive ramifications for the stock market, which is in the initial stages of a recovery. July was a very strong month for stock markets worldwide (MSCI World Net +11.0%), and the Euro Stoxx 50 (+7.5%) and Germany’s blue-chip DAX index (+5.5%) also regained some of the ground they'd lost during the previous months. Medical technology and healthcare services stocks also performed well in this environment. They advanced 9.3% over the month as measured by MSCI World Healthcare Equipment & Supplies and clearly outperformed the broad healthcare index MSCI World Healthcare Net (+6.2%).

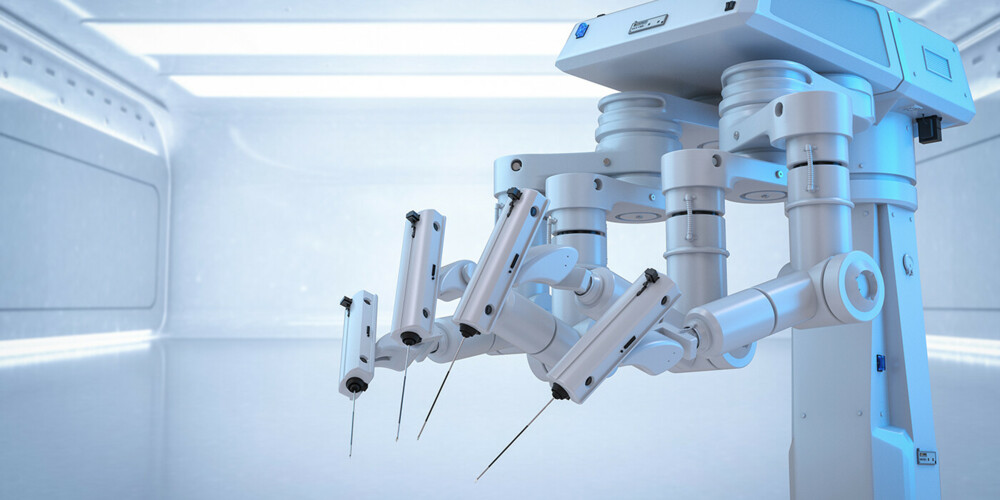

The ongoing second-quarter reporting season is also grounds for optimism. Boston Scientific, Stryker, Danaher and Thermo Fisher, not to mention US health insurers such as Molina or Centene, reported better-than-expected results and investors accordingly bid their stock prices up. Even companies that did not quite meet expectations, such as Align, Intuitive Surgical, and Edwards Lifesciences, also traded higher. This is another indication that investors, emboldened by the better visibility, have clearly tempered their risk expectations, which, in turn, more than offset the slightly lower guidance some medtech companies gave for 2022 as a whole.

Sales grow despite recession

Once considerable uncertainty among investors regarding a potential recovery in medtech procedure volumes after the most recent surge in coronavirus cases has since given way to guarded optimism. Although the medtech sector is not entirely immune to recessionary forces, inflation or interest rate trends, recent statements from medtech company executives have confirmed that the medtech and services sector can still be regarded as a safe haven in times of trouble. Looking back at 2008/09, during the last major recession, most medtech companies continued to report positive sales and earnings growth. Since then, the industry has maintained its progressive development and bolstered its profile as one of the most defensive sectors of the stock market. Medtech stands out for its faster-than-average profit growth and lesser susceptibility to fluctuations. These strengths are definitely attractive in a market environment that leaves investors wondering which way the economy is heading.

Outlook: Acquisitions and new products

The outlook for the medtech & services sector for the rest of 2022 looks good. New COVID-19 cases and hospitalizations in key medtech & services markets (North America, Europe and Japan) have fallen hard and fast since Omicron became the dominant strain of the coronavirus. We believe that the high levels of population immunity will usher in a strong recovery in elective procedures in 2022 and 2023.

The sector’s risk-return profile is enticing for many investors. Regardless of when the pandemic and the geopolitical situation returns to normal, the sector-specific structural growth factors such as rising life expectancy and high rates of innovation will sustain the medtech & services sector's above-average growth versus the overall economy and power its high rates of profit growth. For example, the long-term average earnings per share growth for the MSCI Medtech & Services Index is 12%, which is twice as high as for the MSCI World Index.

Higher material and logistics costs are a reality, but medtech companies are well-managed and will probably be able to compensate for the higher costs. We also expect numerous approvals and market launches of relevant products for diabetes and structural heart disease.

Moderate sector valuations spell opportunities, and not only for investors. We anticipate an increase in M&A activity because the valuation multiples of many promising, fast-growing companies have declined so much.

The Bellevue Medtech & Services Fund (ISIN B-EUR LU0415391431) invests in the entire healthcare market with the exception of drug developers. One reason for the fund’s strong long-term track record is that the medtech & services sector ranks among the most defensive of all healthcare subsectors while also offering solid outperformance potential. That plus an additional bounce in growth from the rescheduling of non-urgent treatments that were postponed during the pandemic create attractive entry points for investors.