Medtech & Services: Innovation offers protection from political instability

By and large, the medtech & services sector got off to a solid start in 2025. Markets did come under heavy pressure in early April, however, when the US announced new tariffs on imports from China and a host of other countries. The Bellevue Medtech & Services Fund (B shares, USD) held steady despite the turbulent environment, delivering a positive year-to-date return of 2.7% as of the end of April. The MSCI World Index (-0.8%), the S&P 500 (-4.9%) and the tech-heavy Nasdaq 100 index (-6.7%), for instance, all showed negative returns for the same period (in USD).

This once again underscores the defensive qualities of the medtech sector and the downside protection it offers, especially when the market gets choppy. The sector’s latest display of relative strength is largely attributable to medtech heavyweights such as Abbott, Boston Scientific, EssilorLuxottica and Medtronic. Most first-quarter earnings reports were much better than expected, but the most critical factor behind the positive performance was the fact that medtech companies were able to quantify the potential tariff-related costs and keep them reasonably well-contained.

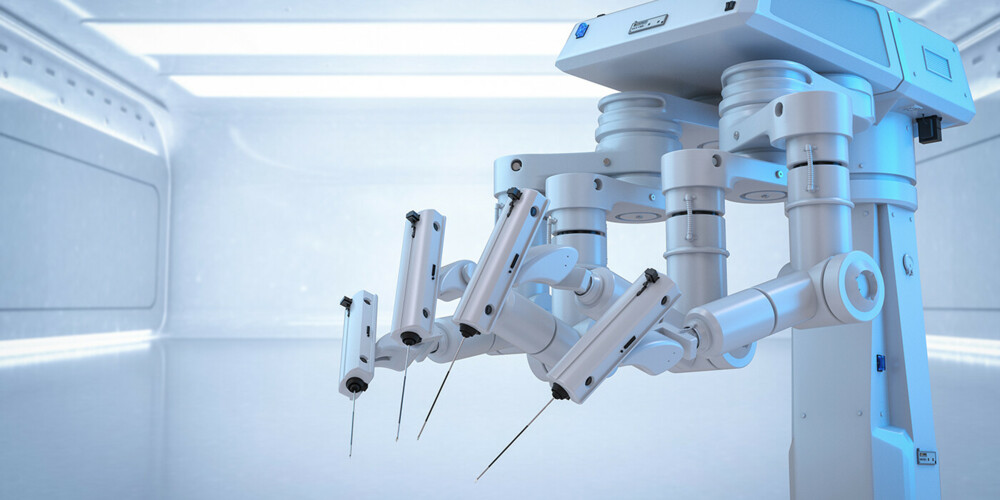

Regardless of the short-term market swings, the fundamental outlook for the sector remains intact. Besides the structural growth drivers, such as the aging baby boomer generation, which is inducing a sharp increase in surgical procedure volumes, the medtech market is enjoying sustained market momentum thanks in no small measure to impressive innovation cycles: In the field of robotic surgery, Intuitive Surgical introduced a major product upgrade with the da Vinci 5 surgical system – its first major upgrade in more than six years. The new da Vinci 5 system improves operational efficiency by more than 20% and outcomes are better too.

In the field of electrophysiology, Boston Scientific has set a new standard with its pulsed field ablation technology (Farapulse): It is faster, safer and more precise than conventional thermal ablation methods for treating atrial fibrillation – a market whose volume is estimated to grow to more than USD 8 bn by 2030.

Medtech is also growing strongly in the diabetes market: Companies such as Dexcom continue to report double-digit sales growth for their continuous glucose monitoring systems, which are increasingly covered by health insurance plans. The market penetration rate of continuous glucose monitoring (CGM) devices among individuals with insulin-dependent diabetes (type 1) in the US is now more than 50% – and rising. CGM devices are already making inroads into the type 2 diabetes (not yet insulin-dependent) segment and they are even in demand as a preventive measure, a market with significantly greater potential. Innovation cycles like these improve operational visibility and strengthen the strategic position of medtech leaders in the marketplace.

Shifting political winds in the US healthcare system?

Political developments in the US represent an additional factor for medtech investments in 2025: Robert F. Kennedy Jr. was appointed as the country's new health secretary. He is known for his critical comments about large pharmaceutical companies and other players in the healthcare system and his controversial anti-vaccine views, so his time in office could heighten regulatory uncertainty – especially for biopharma manufacturers.

However, long-established players such as Boston Scientific, Abbott and Stryker are likely to be fairly well-shielded from this risk. These companies are focused on vital surgical procedures and products, which are less vulnerable to government policies than preventive solutions or new therapeutics.

Trade tariffs – an issue, but not a game changer

The talk about new US tariffs on imports from China, Malaysia, Switzerland and other countries has created uncertainty for a wide range of industries. However, compared to manufacturing or consumer goods companies, the medtech & services sector has so far proven to be much more resilient. The direct impact on business operations has been limited. Only a handful of companies within the sector might be affected. For example:

- Intuitive Surgical has set up some manufacturing operations in Mexico but, thanks to the USMCA free trade agreement, most of its production output will likely remain exempt from any new tariffs.

- Dexcom manufactures some of the components used in its glucose monitoring devices in Malaysia – which could theoretically lead to some extra tariff-related costs. That said, Malaysia has so far been more of a bystander in the US tariff crusade.

Industry analysts estimate that the potential risk could lower Dexcom's EPS by 2-6% – which is far less than the estimated 10-20% hit that more globalized industries are exposed to.

In addition, a substantial chunk of Dexcom’s product portfolio could be protected from tariff action by international agreements, such as the Nairobi Protocol. Under this multilateral agreement, medical devices specially designed or adapted for the use or benefit of disabled persons are exempted from tariffs. This includes critical products such as continuous glucose monitoring systems or devices for the treatment of sleep apnea, both of which are growing market segments. And even if new tariffs are imposed, the tariff-related risk would clearly be mitigated by the high rate of manufacturing localization:

- Many leading medtech companies today have set up production sites in the US – in some cases localization rates exceed 70%.

- What’s more, they also have flexible supply chains and manufacturing networks that can be quickly adapted in the event of regulatory change.

The medtech industry's current strategic positioning – local production, specialization in critical healthcare products and services, and far-sighted regulatory management strategies – thus provides sound protection against short-term tariff risks. In addition, the US dollar’s current weakness is an advantage for export-oriented, highly vertically integrated medical technology companies that have US-based production sites, because a weaker dollar lowers the cost of their products for foreign buyers and thus makes them more competitive on the international stage.

Valuation: On solid ground with catch-up potential

The fund's portfolio is relatively concentrated and currently has a defensive slant. The number of positions is at the lower end of the typical range of 40 to 60 stocks, and 96% of portfolio assets are invested in large-cap medtech names. The average market cap of the stocks in the portfolio is USD 60 bn.

In terms of fundamentals, the portfolio offers strong sales growth of more than 9% p.a. over the next five years. Average estimated EPS growth is about 14% p.a. – which likewise underscores the long-term fundamental strength of the companies in the fund's portfolio.

Looking at valuation metrics, the medtech & services sector was trading at a substantial discount to the total market from the beginning of 2025 until the end of February. This changed in March: The valuation spread began to narrow as the S&P 500 experienced a significant multiple contraction, while tech stocks sold off, converging with the more stable medtech & services sector.

Despite these moves, large-cap medtech stocks are still trading at a slight discount of about 1% compared to the S&P 500. Historically, however, large-cap medtech names usually traded with a premium of 10 to 20%. From this angle, medtech’s current valuations are still attractive.