Africa investments: Solid fundamentals contrast with low stock valuations

We met 40 to 50 companies operating across 10 to 15 African countries during our last two business trips that ended in mid-October. It was the right time to discuss business outlook with the management teams given they had a better understanding of the opportunities and challenges ahead, especially after what they went through since the Russia/Ukraine war.

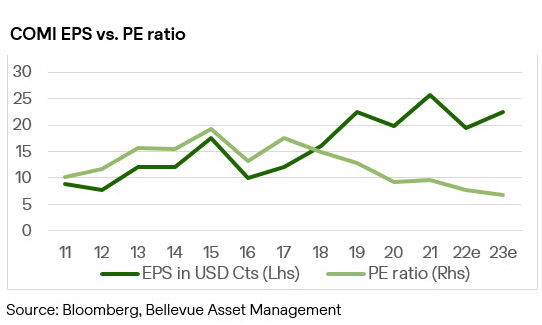

Overall, corporates guided for resilient earnings despite the current inflationary pressures, rising lending costs and devaluation of local currencies vs. the USD. They sounded more confident in the future than what their historically low valuations imply, contrasting with the current sentiment towards African equities which overlooks a more promising growth potential already visible on the ground.

Many African companies are used to operate in a tough business environment

The corporates we invest in built, over the years, a certain resilience against external and domestic shocks helping them deliver commendable results under challenging business conditions. Some of them ended up stronger after a crisis as they consolidated their market shares at the expense of smaller players in the informal economy. These two factors are at play this year and were evident during our discussions.

We also learnt that the extra-saving accumulated since the pandemic helped Egyptian consumers absorb the 30-to-40% price increases vs. 2021, with volumes in the FMCG sector being steady ytd. Obour Land, Egypt’s leading white cheese producer, even posted an impressive 16% volumes growth yoy after its multiple price hikes this first half. In Morocco, some companies in the consumers or healthcare complex were outright bullish, expecting double-digits earnings growth this year and beyond.

Long term investors are seizing the opportunity to buy qualitative companies at cheap valuations

A low valuation, earnings resilience and attractive growth outlook are part of the recipe for a re-rating in African equities. Ultimately, markets always catch-up with fundamentals, especially if corporates keep growing their bottom line and the best evidence of it is that some investors saw the opportunities lately.

Since the devaluation in Egypt last March, the sovereign funds of Saudi Arabia, the UAE and Qatar invested billions of USD in names listed on the stock market but also in state-owned enterprises not trading publicly. The same buying spree is undergoing for big conglomerates that have a presence on the continent. Last October, Diageo, the UK-based beer and spirits producer, bid a 40% premium to acquire a 15% stake in its subsidiary East African Breweries. Last September, Crédit Agricole, the French bank, acquired a 5% participation in Crédit Agricole Egypt. In Late 2021, Vitol, the global commodities trader, bid a 25% premium to buyout the minorities in Vivo Energy, a leading fuel distributor in Africa.

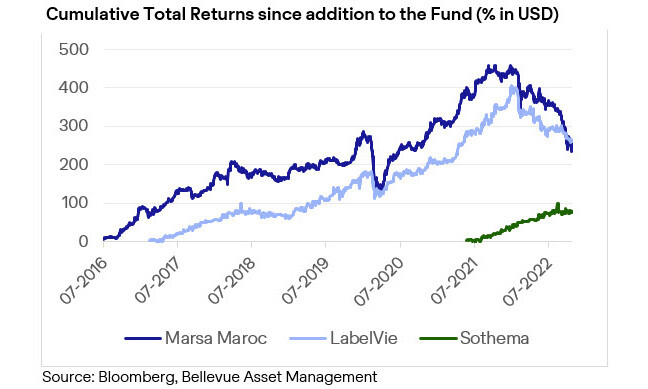

We were or still are investors in these three African stocks above and the aforementioned transactions are testament of the high fundamental value embedded in several positions we have in the portfolio.

Morocco remains core to the fund’s long-term investment strategy

Morocco is the nation with the most stable and resilient macroeconomic situation in our universe thanks to the structural reforms implemented over the past 10 to 20 years. This macroeconomic stability allows the Kingdom to focus on sectoral reforms that bring direct opportunities through some listed companies.

Our role as investors in Africa is to access these structural reforms which are growth enablers local companies leverage to grow. This is a key feature of our investment approach and explains Morocco’s high allocation within our portfolio even though local equities’ performance this year is underwhelming. We are not overly concerned by short-term corrections on the market as we are confident the structural growth themes we hold in the portfolio will continue to deliver strong and sustainable earnings growth.

Our last business trip backed up our core investment ideas in Morocco

A theme that came up frequently during our ground visit in October was the healthcare sector reforms in Morocco. Around 21% of the population have a health insurance today and the government’s goal is to move this rate to 70% by 2024. This should allow more Moroccans to access a wider range of pharmaceutical products and healthcare services.

Sothema, the leading pharmaceutical group in Morocco, is well positioned to thrive once these reforms are voted into law. We invested in the company last year, first, because it is likely to benefit from the expected pick-up in drugs demand post reforms. Second, because Sothema has the knowhow and size to contribute to Morocco’s drugs self-sufficiency. In fact, at the height of the COVID-19 crisis, Sothema played a critical role in supplying locally insulin and other medicines when their global availability was low.