Low fee.

High impact.

Marketing Communication

Top healthcare stocks in an active ETF

The healthcare market is one of the most attractive structural growth markets in the world. The Bellevue Healthcare ETF – an exchange-traded, transparent and cost-effective investment vehicle – offers you easy access to an actively managed portfolio of healthcare sector leaders. You also benefit from Bellevue Asset Management’s long-standing expertise as a healthcare investor.

Why invest in the healthcare sector?

Healthcare in investment portfolios – growth potential with a diversification effect

Driven by demographic aging, the growing prevalence of lifestyle-related diseases, and strong innovation, the healthcare sector has become one of the largest growth markets in the world – and its potential is immense. The sector also offers relevant diversification benefits for client portfolios thanks to its comparatively low correlation with the broader stock market.

Why Active ETF?

More than an index – targeted stock selection makes a difference when investing in the healthcare universe

An active ETF (exchange traded fund) combines the advantages of an ETF with the potential rewards of active management. The Bellevue Healthcare ETF is managed by a highly experienced portfolio management team. While a passive ETF replicates a chosen index, an active ETF is designed to outperform the index. The composition of the ETF portfolio and the individual weightings are actively monitored and adjusted to address evolving circumstances and opportunities with the aim of generating an excess return.

The specific characteristics of the healthcare sector are tailored to an active management approach and the generation of alpha.

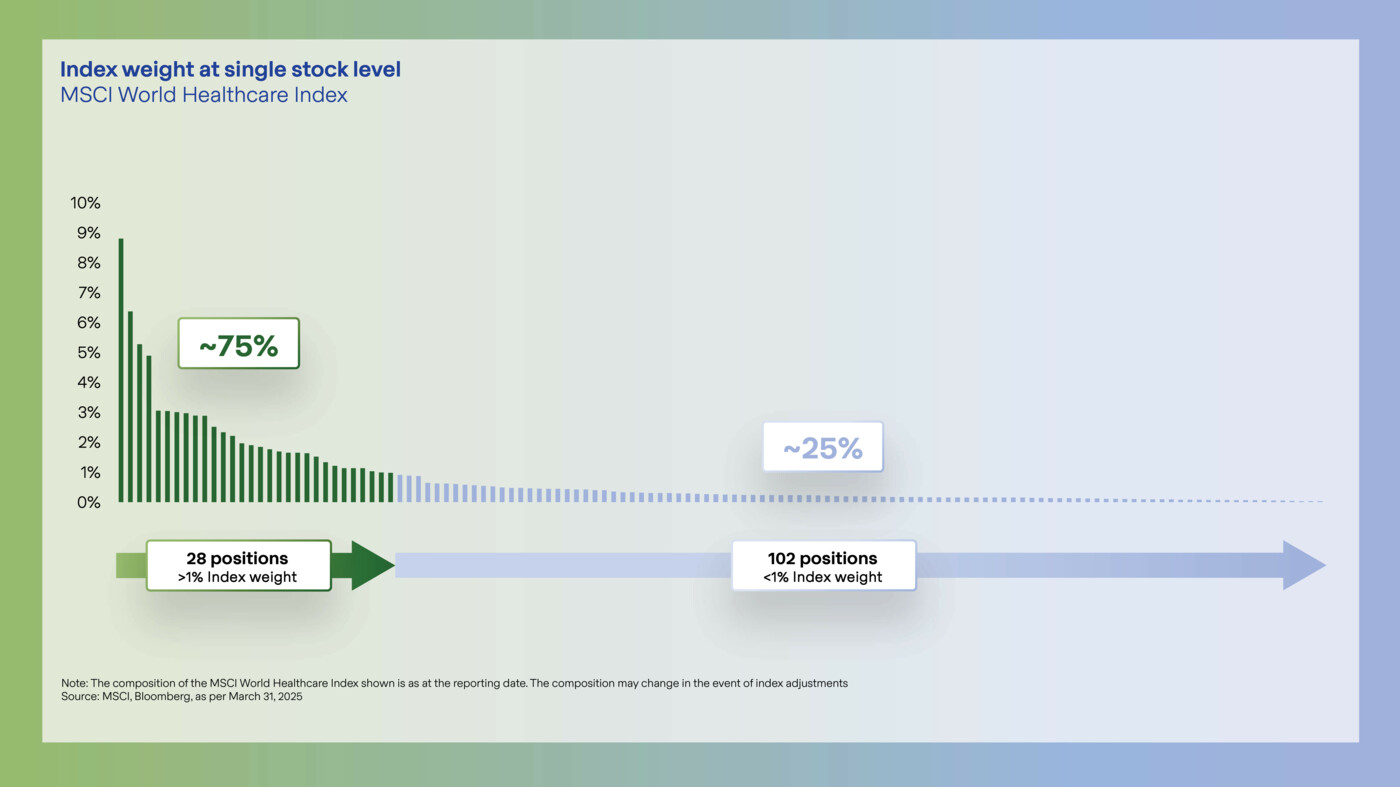

Index composition offers opportunities and challenges

The MSCI World Healthcare Index is dominated by the 28 largest stocks in the index, which account for about three-quarters of the index capitalization, while the remaining 102 stocks – many of which are faster growing companies – account for only 25% of the index cap. This represents a broad and diverse field of opportunities for experienced active managers to identify valuation distortions and overweight or underweight specific stocks.

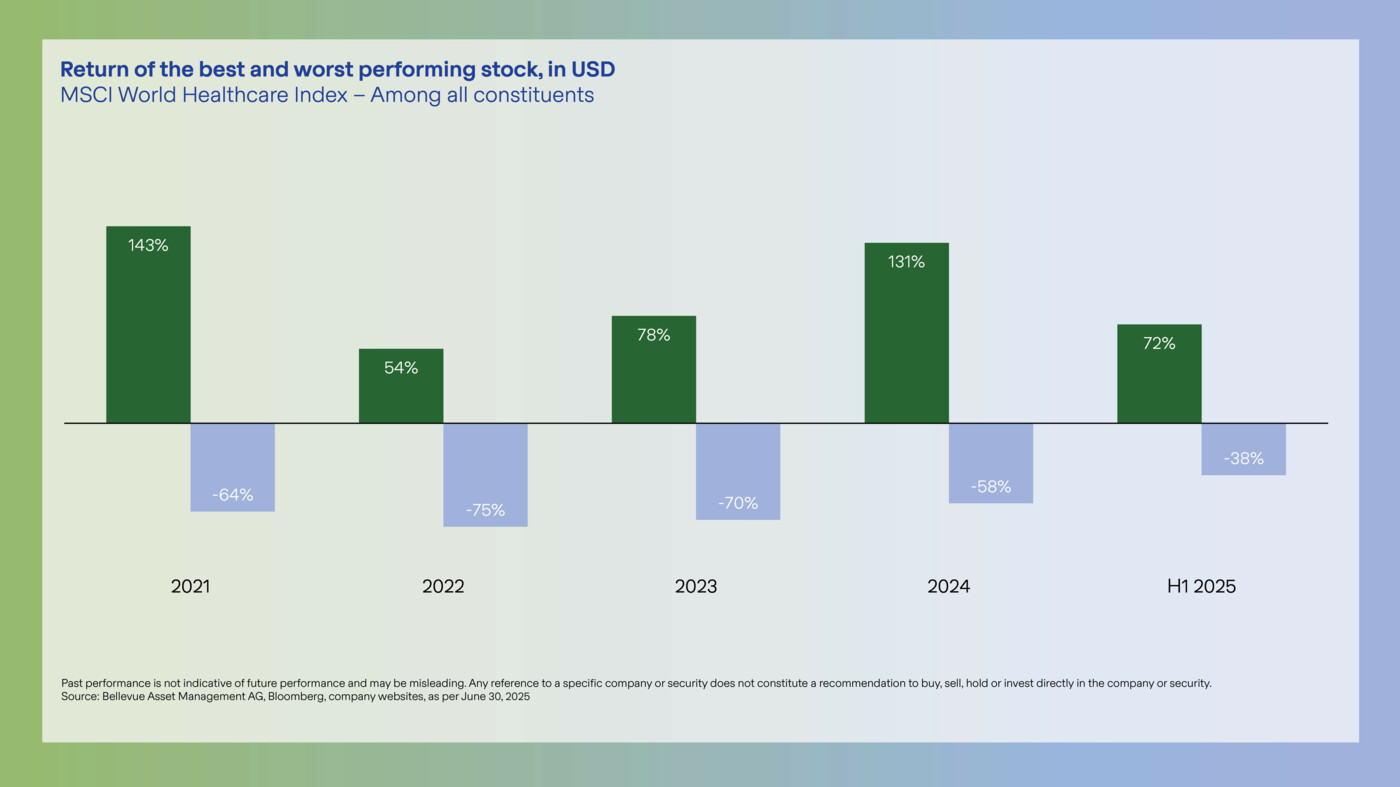

Wide divergence of returns

+131% versus -58% – the wide spectrum of returns between the best and worst-performing stock in the MSCI World Healthcare Index in 2024 shows that investing selectively can deliver significant alpha. An ideal starting point for active management.

Why Bellevue?

Keeping a finger on the pulse of the healthcare market since 1993

Healthcare is a complex and highly dynamic market that require solid expertise in every aspect of the industry.

Established in 1993, Bellevue Asset Management is recognized as one of the pioneers in the healthcare space. We are proven experts in managing active, fundamental research-based healthcare investment vehicles. We boast a long and successful track record and have years of experience across the market cycle.

Invest in one of the world's largest growth markets – through Bellevue’s smart vehicle for excess return.

Bellevue Healthcare ETF

Active portfolio management combined with the advantages of an ETF

With the actively managed Bellevue Healthcare ETF, Bellevue Asset Management’s vast expertise in the healthcare sector is integrated into an exchange-traded, transparent and cost-effective investment vehicle. Our healthcare experts invest in the most promising and relevant stocks from the global healthcare index MSCI World Healthcare – with the aim of outperforming this index.

Video interview

Healthcare meets returns: why Bellevue is launching an active healthcare ETF

Investment approach

Aiming for excellence – Bellevue selects with conviction from more than 130 stocks

- The fund's investment universe is the MSCI World Healthcare Index, which comprises 130 to 140 large and mid-cap companies from more than 20 developed countries.

- We pick 50 to 100 of the most promising stocks for our actively managed ETF portfolio based on the results of our fundamental research.

- Our investment research assesses the relative strength of the fundamental data (e.g. competitive advantages), valuation metrics and risk/return considerations, research and differentiation scores (e.g. in talks with experts) as well as stock catalysts (e.g. regulatory approvals).

- The resulting conviction determines whether we overweight or underweight individual stocks relative to the index.

- The maximum range of weighting deviation is clearly defined for risk management purposes.

- This active approach enables us to respond flexibly to shifting market dynamics within the global healthcare sector, with the aim of delivering enduring, tangible value to our investors.

Documents

Facts & Figures

| Domicile | Ireland (UCITS ICAV) |

| Investment manager | Bellevue Asset Management AG |

| Benchmark | MSCI World Healthcare Index |

| Investment approach | Active, Fundamental Bottom-Up |

| EU SFDR 2019/2088 | Article 8 |

| Listing date | SIX Swiss Exchange: September 18, 2025 Deutsche Börse Xetra: September 19, 2025 |

| Currencies | USD (Base currency) CHF (unhedged) EUR (unhedged) |

| Listings | SIX Swiss Exchange (USD, CHF) Deutsche Börse Xetra (EUR) |

| ISIN | IE000R6TN604 |

| Ticker | USD (CARE) CHF (CARE) EUR (C4RE) |

Have we sparked your interest?

We would be happy to send you further information. Please fill out the form below or contact your advisor.

For professional investors only.